In comparative terms, hospital bond proposal spends tax dollars bigly

The bond is larger, and uses more tax dollars, than bonds issued by comparable hospital districts.

The Huntsvillan surely speaks for us all in saying we are not experts at building hospitals. Building a doghouse is plenty difficult for us. So what to make of the bond proposal that the Walker County Hospital District has placed on the Nov. 4 ballot?

Well, we just did what everyone else does: turn to the internet. Typing "for the love of God, what's up with this bond issue we thought was settled months ago" into Google, it came up with this: the Bond Review Board.

What??? There is an actual state agency with the same name as our favorite Backstreet Boys cover band? Now you have our attention!

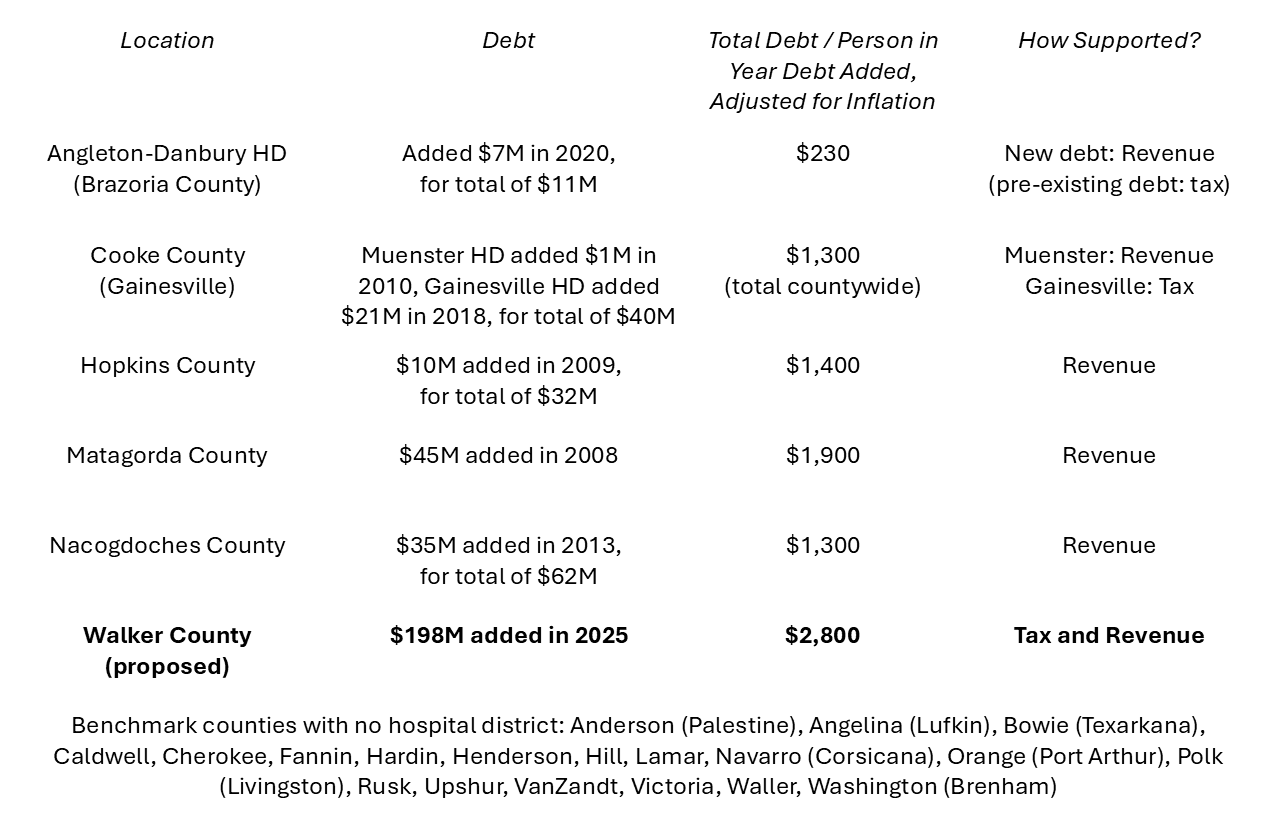

We learned things. Namely, that the Bond Review Board tracks the public debt of each hospital district in Texas, annually. And whether that debt is paid off with tax money, revenue from its operations, or a mix of the two. Now we can see how Walker County's proposed bond compares to other similar counties.

The bottom line: most comparable counties don't have any public debt at all, because they don't have a hospital district. Any hospitals are in the private sector. For the remainder, the debt is smaller than in Walker County's proposal and is typically supported by revenue, not taxes. The proposed bond is somewhat unusual in size and quite unusual in relying on tax dollars.

The Nitty-Gritty

There are an awful lot of hospital districts, so we focused on "benchmark" counties that weren't too far away (within about 250 miles) or too different in size (within 35,000, or half, of our population). That gave us 24 counties in addition to Walker.

Of these 24 counties, 19 had no hospital district. The remaining five all added some debt over the past twenty years. To make an apples-to-apples comparison, we adjusted this debt for inflation and divided it by the population of the hospital district in the year that the debt was added. And then we put it in a table, because we like tables.

Most commonly, there is no hospital district and thus no public debt. For example, Lufkin has a hospital–two in fact–but no public debt, because both hospitals are in the private sector.

Just six hospital districts (in five counties) issued debt. The total debt per person generally ranged from $1,000 to $2,000, and it was typically supported by revenues, not taxes. For example, Nacogdoches County's hospital district has plenty of debt–but none of it is owed by the public. It is supported by revenues from its hospital.

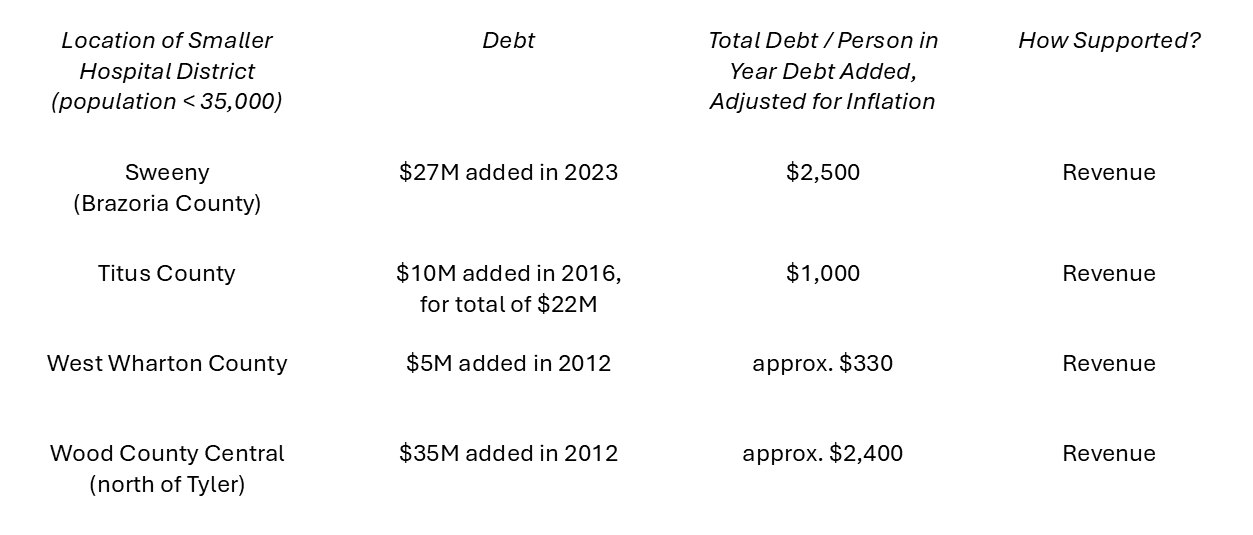

We also found four other, smaller hospital districts that issued sizeable amounts of debt. Here the per capita amounts are somewhat larger, generally ranging from $1,000 to $2,500. This debt is always supported by revenues.

Walker County's bond proposal stands out in two ways. At $2,800 of debt per (free world) resident, it is larger than in all nine comparison districts, even adjusting for inflation. It is also rare in having a substantial tax component. Only Gainesville Hospital District's 2018 bond had tax support.

The Gainesville case is instructive. Its 2018 debt was added in a restructuring after bankruptcy the previous year. It has been paying this off at a steady rate, and the current debt service tax is $54.30 per $100,000 valuation. For the Walker County proposal, the estimated maximum tax is twice as high: $105.40.

To conclude: of the comparable counties we examined, the vast majority have no hospital district. Of those that do, the vast majority cover debt through revenue, not taxes. For the one that did use taxes, the burden is half that of Walker County's bond proposal. That proposal spends tax dollars bigly, in comparative terms.

And Then Things Went Off the Rails

Here you'd expect to read a response from the hospital district commenting on our findings. But you won't because we ran into the dumbest problem ever.

We asked the hospital district–very nicely–for the e-mail address and phone number of all five members of the board, so we could reach out for comment. But they provided only the e-mail address of one. This is unacceptable. The elected officials who set tax rates and put this bond on the ballot shouldn't be unreachable.

So we made a second request–not as nicely–and waited. After giving them a week, we published this article.

The questions we would ask, had we the means to do so, are basic. What reason is there for proposing a relatively large bond? Why does it need so much tax support, when comparable areas do with less or none at all? And so on.

We would ask some other questions, too. Why have one member of the hospital district board and two executives at Huntsville Memorial Hospital checked out our requestor on social media? The hospital is distinct from the hospital district, and located three miles away--so how did hospital executives even find out about this? Is it a HIPAA violation? What the heck is going on?

These latter questions may be uncomfortable to answer. Maybe it's best the board members are unreachable for now. But don't worry, Walker County Hospital District. This article may be done, but there will be others. Talk to you soon!